About Course:

What Will You Learn:

- Understand the concepts of trading sideways markets and when they are likely to occur.

- Identify and define sideways markets across various market cycles.

- Explore multiple methods to measure market types and determine the most suitable one for you.

- Implement strategies for trading based on market volatility, including options spreads, condors, and butterflies.

- Use options to hedge, speculate, and generate income in sideways markets.

- Apply effective risk management techniques for options trading.

- Develop the psychology and mindset necessary for successfully trading sideways markets.

- Learn techniques to create and follow a structured trading plan.

- Build a long-term trading strategy adaptable to all market types.

- Gain practical skills through simulations and real-world examples.

- Adapt and succeed in both quiet and volatile sideways markets.

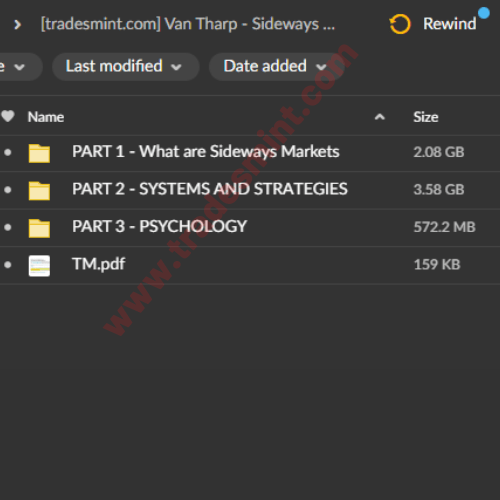

Course Content

What are Sideways Markets?

- Introduction – Outline and Overview

Market Type Overview

- Market Type Overview

- Determining Market Type

- Calculating Market Type

- Other Ways to Determine Market Type

- Bottom Line

- Historical Examples

Big Picture

- Big Picture

- Dalio Video Discussion

- Sentiment Indicators and Ted Spread

- Monitoring Plan and Big Picture Examples

Sideways Psychology

- Sideways Psychology

Introduction to Options

- Introduction to Options

- Options Normality

- Options Volatility

- The Option Greeks

- Options Pricing Basics Quiz

- Option Strategies

- Leaps

- Examples

Systems and Strategies

- Systems & Strategies: “Immunizing” Portfolios

- Strategies for longer-term investors in sideways quiet markets

- Strategies for longer-term investors in sideways volatile markets

- Strategies for intermediate term/swing timeframe in Sideways quiet markets

- Quick overview of Think or Swim Options capabilities

- Strategies for short-term Day Trading in Sideways volatile markets

- Rocks And Rockets System

- Options Strategies for Sideways Markets

- Strategies for Sideways Volatile Markets-Day Trading RLCO-based systems: The Owl

- Z3PO

- Collapsing Dragon

- Strategies for short-term/day trading in Sideways quiet markets

- ARLS System

- Bounce System

- Simulations

Psychology

- Personal Psychology in Sideways Markets

- Final Q&A

Reviews

There are no reviews yet.