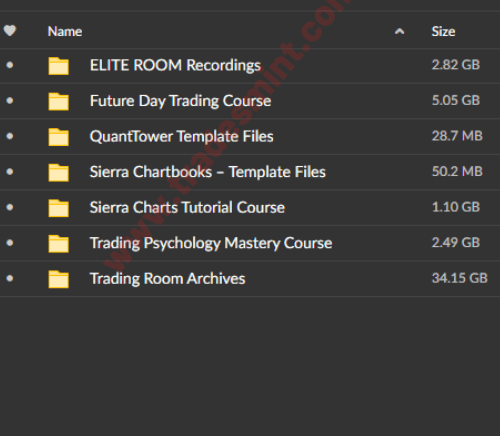

About Course:

Futures Day Trading

Professional Development Program

The biggest mistake failing day traders make is starting to trade unprepared and blowing up their account. This failure creates self-sabotaging patterns that are hard, and often impossible to overcome. It is very important to learn day trading the correct way.

Day trading carries a much higher degree of emotionality. In these fast changing markets, it is critical to have an understanding of the tools institutions and professionals are using. You have to learn how to trade like the professionals, or you will end up going against them.

There are 3 pillars of order flow trading you need to know:

Tracking Big Orders in the Book

Being able to read the real-time book of orders is a top priority skill for institutional traders. This is also called level 2 or “market depth”. You can spot big orders, and use this information to forecast future price movement and where to enter a trade with low risk and high probability. You must know how to read an auction as a day trader.

How Institutional Orders are Changing and Moving

Track if there are new buy or sell orders being added to the market, or if they are being removed. This skill will help you understand the strength and momentum shaping up for a future move. It is also vitally important to spot orders moving in the book, as it confirms or rejects price levels and big moves. Catch fake-outs, reversal and continuations.

Market Imbalances

Market orders move the market. You need to understand how and when orders are actually “traded”. Imbalances help you find high quality entry points, stop runs from retail traders and spot where the big money actually executes their trades. This tool alone gives you laser precision in entry and trade management, and a huge edge in your strategy.

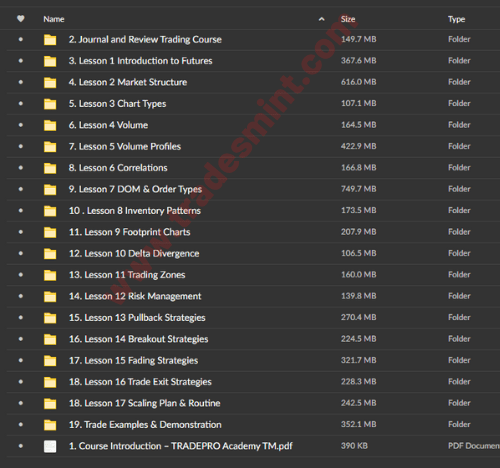

Course Itinerary

- Lesson 1: Introduction to Futures

- Lesson 2: Market Structure Basics

- Lesson 3: Chart Types

- Lesson 4: Volume Principles

- Lesson 5: Volume Profile / Auction Market Theory

- Lesson 6: Market Correlations

- Lesson 7: DOM & Order Types

- Lesson 8: PRO Inventory Patterns

- Lesson 9: Footprint Charts – Market Imbalances

- Lesson 10: Delta Divergence

- Lesson 11: Trading Zone Formation

- Lesson 12: Risk Management Techniques

- Lesson 13: Pullback Trading Strategies

- Lesson 14: Breakout Strategies

- Lesson 15: Fading Strategies

- Lesson 16: Trade Exit Strategies

- Lesson 17: Account Scaling Plan & Routine

- BONUS: Trade Examples & Demonstrations