About Books:

In this package, you’ll receive the download links of following books:

- 15 Lies About Trading and Investing

- Fooled By Technical Analysis

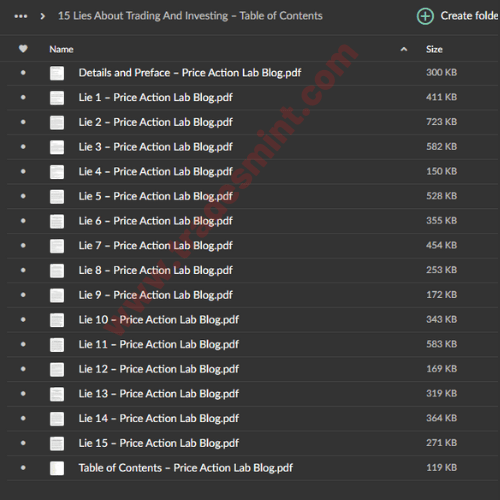

15 Lies About Trading and Investing – Table of Contents

- Preface

- Lie 1: Trends and friends.

- Lie 2: The story about losses and profits.

- Lie 3: This is the true edge.

- Lie 4: They like macro bets.

- Lie 5: Market timing bashing.

- Lie 6: The victims of HFT

- Lie 7: They hate forecasting.

- Lie 8: The momentum premium.

- Lie 9: Advertising low win rates.

- Lie 10: Timing versus hoping.

- Lie 11: Statistical analysis conundrum.

- Lie 12: No emotions allowed.

- Lie 13: Random following works.

- Lie 14: Optimality is the key.

- Lie 15: Back testing windfall profits.

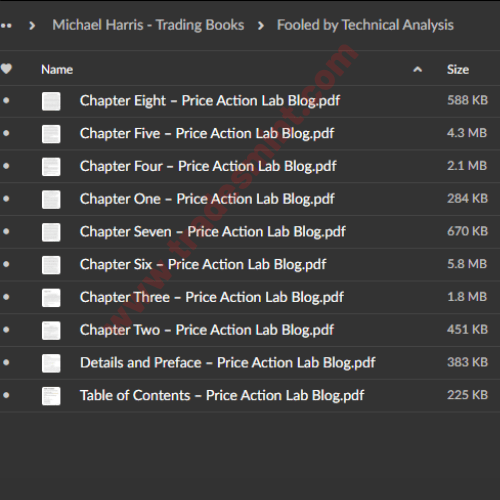

Fooled by Technical Analysis: The perils of charting, back testing and data-mining

PART I – Basic Concepts

Chapter 1. Levels of Technical Analysis

- Level I Naive chart analysis

- Level II Expert chart analysis

- Level III Naive quant analysis

- Level IV Expert quant analysis

Chapter 2. Trading Expectation

- The need for large trade samples

- The trading system inversion paradox

Chapter 3. Risk of Ruin and Trading Capital Requirements

- Risk of ruin due to undercapitalization

- Risk of ruin and win rate.

- Low win rate impact on trend-following system performance

- Determining initial capital requirements

Chapter 4. Trading Timeframes and the Impact of Trading Friction

- Trading Timeframes

- Trading Styles

- Trading methods

- The Negative-Sum Game of Futures and Forex Trading

- Daily E-mini trading

- Intraday E-mini trading

- Daily Forex trading

- The impact of a long-term market bias

Part II. Fooled by Technical Analysis

Chapter 5. Naive and Expert Chartists

- Fooled by random chart patterns.

- Use of chart patterns defies logic.

- Chart patterns and self-fulfilling prophecies

- Chart Patterns are mostly flukes.

- Claims of Chartists debunked with simple math.

- Fooled by random indicator patterns.

- Indicator patterns and self-fulfilling prophecies

- Indicators and wishful thinking

- Chart analysis and cognitive biases

- Expert chart analysis

Chapter 6. Naive and Expert Quants

- What is Back testing

- Pitfalls of back testing

- Methods for discovering a trading edge.

- Fooled by hypothesis testing.

- Fooled by validation tests.

- Fooled by Monte Carlo Simulations

- Expert quant analysis

- Minimizing the impact of data-mining bias

- Classification of trading systems

- Selection of systems

- Data snooping bias

- Myths about data-mining bias

- Pitfalls of validation methods

- Quant discretionary trading

- Fooled by momentum strategies.

- Putting it all together

Chapter 7. Position Size Determination Methods

- Basic types of trading systems

- Systems with stops-loss

- Fooled by optimal methods.

- Systems without stops-loss.

Chapter 8. Alternatives to Technical Analysis and Conclusion

- Trading the news

- Social media sentiment and trends

- Esoteric trading methods

- Conclusion