How Is This Course Different From Other AMT Courses?

You might be wondering, “How is this program different from others?”

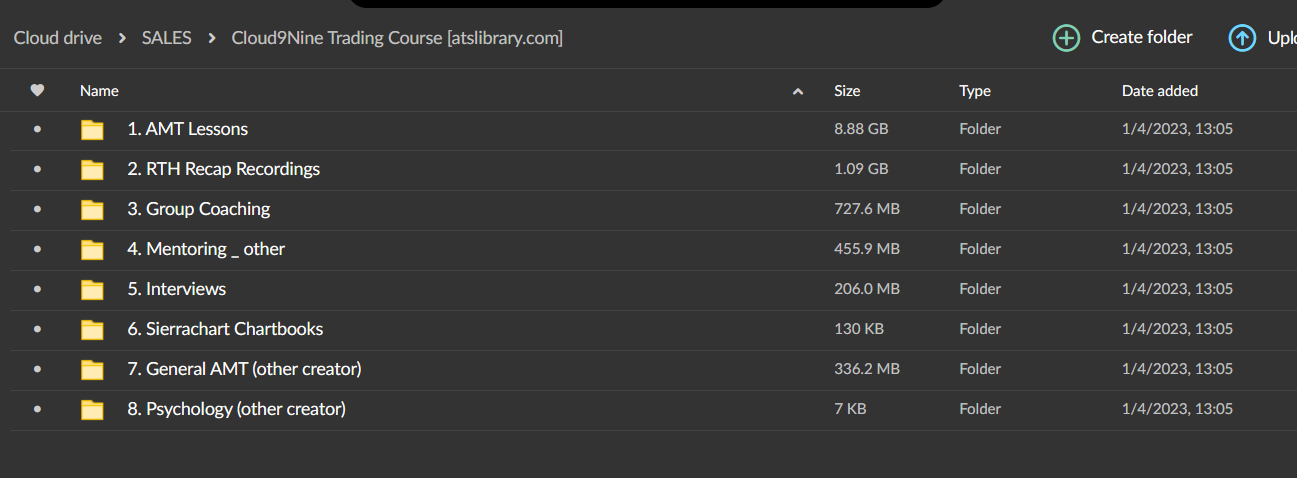

Table of Contents:

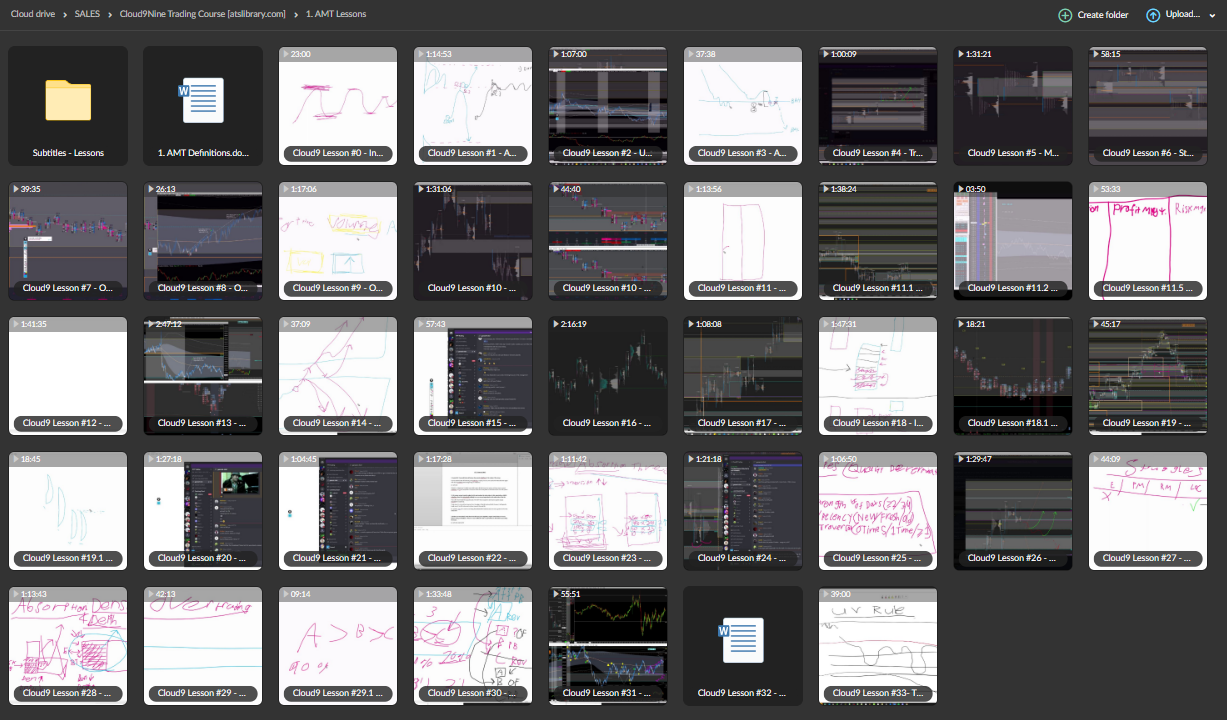

Module 1: Location Filters

1-AMT Foundations, Setups, and How to Find Levels

2-Developing a Story

3-Acceptance

4-Trading the ‘Current Auction’

5-The Secret Sauce Behind AMT Levels

6-Combining AMT with the power of Statistics

Module 2: Orderflow Execution

7-Orderflow: Reading Delta & Positioning

8-Orderflow: How to REALLY Read Cumulative Delta the Right Way.

9-Orderflow: Secret ingredients of a Reversal

10-Orderflow: Absorption | Whales & Sharks

11-Orderflow: Footprint Reading | Machine Gunners & Snipers

Module 3: Trade Management

12-AMT Nuances and Variations

13-How to Add to Winners the Right Way

14-Profit Management

15-Risk Management

16-Execution

17-How to Bet Size the RIGHT Way: A Data Driven Approach.

Module 3: Advanced Orderflow

18-Market Profile Patterns

19-Advanced Orderflow: Absorption Limits.

20-Advanced Orderflow: Absorption Walls.

21-Advanced Orderflow: Turning the Numbers into Relative Percentages.

22-Advanced Orderflow: Quantifying Orderflow.

Module 4: Mental Management

-Trade Visualizations.

-Outcome Permutation Visualizations.

-Thinking in Bets & High RR Locations.

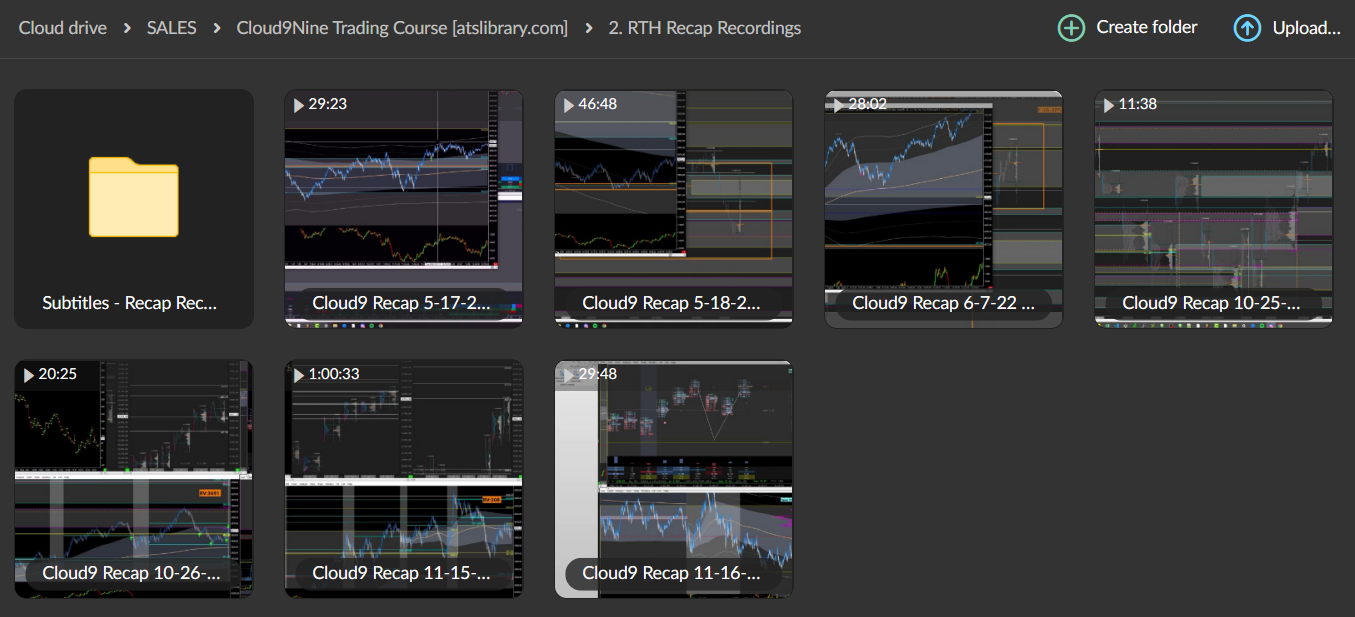

-Post RTH Recap Visualization.

Module 5: Other

-How to create and automate statistical backtests yourself using SierraChart. (Coming soon)