About Course:

The workshop covered various strategies, including:

- Jim Olson Iron Butterfly: This strategy involves a wide butterfly spread initiated at the start of trading, with trades typically lasting 10-20 minutes.

- Narrow Iron Condor: Dan Harvey introduced the Narrow Iron Condor, which combines elements of both the Iron Butterfly and Iron Condor strategies. It has demonstrated a strong track record with an 80-85% success rate among participants.

- The Morning Fade: Scot Ruble, who previously used this technique as a market maker in the CBOE pits, shared his insights. This strategy boasts an approximate 80% success rate.

- Trading the Market-on-Close (MOC) Buy/Sell Imbalance: Scot Ruble also discussed his approach of using MOC buy/sell imbalances at the end of the trading day to take long or short positions, provided specific conditions are met.

- The Wide Iron Butterfly: Amy Meissner shared one of her preferred strategies, which has yielded excellent results.

- Amy’s Iron Condor Variations: Amy Meissner also covered her favorite iron condor strategies.

- Wayne’s Calendar Spreads: Wayne Klump explained how he trades Calendar spreads using his proprietary tools.

- Out-of-the-Money Vertical Spreads: Tom Nunamaker detailed his approach to utilizing far-out-of-the-money vertical spreads that expire on the same day to generate profits. In February, he executed 12 of these trades, all of which were successful and collectively yielded just under $900. These trades utilized $3,000 to $9,000 of margin each day.

- Breakeven Iron Condor: John Einar’s most profitable options trade, with an annual yield exceeding 70% over 16 months of trading, was discussed. Tom Nunamaker also demonstrated an easy method for implementing these trades on the thinkorswim platform.

- Asymmetric Risk Butterflies: Ernie at 0-dte.com employs asymmetric risk trades to achieve favorable results with low risk. Tom Nunamaker provided insights into this trade type and how to identify suitable candidates quickly.

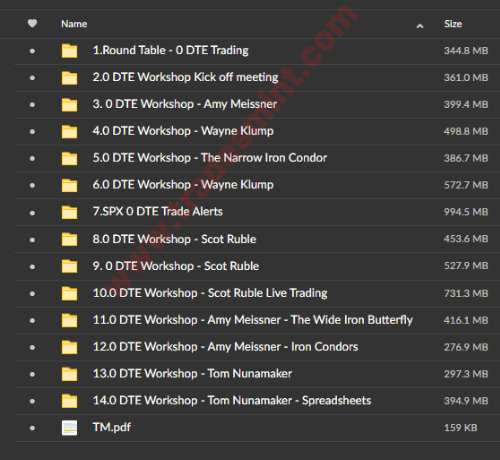

0 DTE Workshop Overview

Session 1

Amy Meissner, Dan Harvey, Tom Nunamaker, Wayne Klump and Scot Ruble

- Kick Off Meeting

Session 2

Amy Meissner

- Amy will cover the different approaches of 0DTE trading, the strategies that can be utilized, and the key elements of what to look for when evaluating a 0DTE strategy.

Session 3

Wayne Klump

- How to allocate capital with proper diversification across different strategies using known risk metrics…and why you should.

Session 4

Dan Harvey and Tom Nunamaker

- The Narrow Iron Condor

- Trade guidelines

- Trade examples

- Using the Narrow Iron Condor Expediter (NICE) Spreadsheet

Session 5

Dan Harvey and Tom Nunamaker

- Live trading of the Narrow Iron Condor recording

Session 6

Wayne Klump

- Structural edges and using fundamental metrics to balance risk across multiple strategies

- An introduction to the Adapt Intraday Options

Session 7

Scot Ruble from StrategemTrade

- Unbalanced Condors

Session 8

Scot Ruble from StrategemTrade

- The Morning Fade

- Trading the MOC Imbalance

- Short Butterfly

Session 9

Scot Ruble from StrategemTrade

- Live trading recording

Session 10

Amy Meissner

- The Wide Iron Butterfly

Session 11

Amy Meissner

- Amy’s Iron Condor Variations

Session 12

Tom Nunamaker

- Jim Olsen Iron Butterfly

- Breakeven Iron Condor

- Asymmetric Risk Butterflies

- Vertical Spreads

Session 13

Tom Nunamaker

- Spreadsheets walk through

Session 14

Tom Nunamaker

- Live trading recording